Did you know that 82% of business failures result from poor cash flow management or a fundamental misunderstanding of how cash flows work? For small business owners, mastering cash flow management isn’t just an accounting task—it’s a make-or-break factor that determines whether you’ll weather financial storms or close your doors. In this comprehensive guide, you’ll discover insider hacks, actionable strategies, and essential practices so you can keep your business thriving with healthy cash flow year-round.

How Cash Flow Management Can Make or Break Small Business Success

For many small businesses , cash flow management is more than just tracking incoming and outgoing funds—it's the heartbeat of daily operations. When you understand and effectively manage cash flow, you control the amount of money available to pay suppliers, employees, and fuel growth opportunities. Poor flow management can lead to missed payments, emergency loans, or, worst-case scenario, business closure.

Many entrepreneurs mistakenly believe profits guarantee security, but overlooked expenses and unpredictable cash outflows easily throw operations into disarray. Conversely, a business with thin margins can not only survive but thrive with strong cash flow management . Prioritizing the regular review of cash inflows and outflows allows you to respond proactively—avoiding costly overdrafts, capitalizing on supplier discounts, and staying ahead of seasonal slumps. Real-world examples abound: a florist may have strong Valentine’s Day sales but struggle with offseason bills, while a startup may burn through cash reserves due to client payment delays. The difference between their survival often lies in modern flow management strategies.

Cash Flow Management by the Numbers: Surprising Statistics on Business Failure

"82% of business failures are due to poor cash flow management or poor understanding of cash flow" - U.S. Bank Study

Statistics paint a clear picture— cash flow management is not optional, but essential. Even profitable companies face closure if their flow analysis and management practices fall short. By focusing on actionable steps to manage cash flow and interpreting your cash flow statement accurately, you greatly increase your odds of long-term success.

Mastering Cash Flow Management: Key Concepts for Small Businesses

- What is cash flow management and why is it vital?

- Rewarding benefits of healthy cash flow

- Common pitfalls in managing cash flow

- Signs of negative cash flow to watch

Cash flow management is the process of tracking, analyzing, and optimizing the net flow of money in and out of your business. It is vital because, regardless of your sales, you need enough cash inflow to pay bills on time and take advantage of growth opportunities. Missing a critical expense or misjudging the timing of payments can trigger a negative cycle that's hard to break.

The benefits of healthy cash flow include financial flexibility, stronger vendor relationships (thanks to timely accounts payable), and the confidence to make strategic investments. Yet, many small businesses fall into common pitfalls: relying on outdated payment terms, ignoring rising accounts receivable , or failing to adjust for seasonal trends. All of these can sabotage otherwise profitable companies.

Key warning signs of negative cash flow include regularly using overdraft protection, delays in paying suppliers, mounting unpaid invoices from customers, and a continual decline in your cash reserves. Identifying these early and addressing them head-on is a cornerstone of effective cash flow management .

Understanding Your Cash Flow Statement: A Flow Management Must

A cash flow statement is the best friend of any entrepreneur aiming for healthy cash and financial stability. This vital document tracks the movement of cash across three key sections, helping you pinpoint strengths, weaknesses, and opportunities within your finances. Operating activities detail money generated by day-to-day business, investing activities relate to assets (like equipment or property), and financing activities focus on loans, debts, and owner investment.

Reviewing your cash flow statement each month provides invaluable insight not just into your company’s financial health, but also into potential cash shortfalls or periods ripe for reinvestment. By understanding where your cash inflows and outflows originate, you can react before issues escalate. Effective cash flow management always starts with accurate, up-to-date financial data, empowering better decisions and more confident growth.

| Section | Purpose in Cash Flow Management |

|---|---|

| Operating Activities | Indicates cash generated from core business operations |

| Investing Activities | Shows cash used for or generated from investments and assets |

| Financing Activities | Reflects cash from funding transactions such as loans or investments |

Cash Flow Analysis: How to Read and Interpret a Cash Flow Statement

Cash flow analysis involves carefully examining your monthly or quarterly cash flow statement to uncover patterns and trends in your cash flows . Start by studying your operating cash flow : regular, positive figures show a healthy business model, while declining numbers indicate an urgent need to adjust sales or spending habits. Next, look at investing activities to judge whether large capital outlays are justified by growth prospects or draining your reserves unnecessarily.

Finally, review financing activities for any signs that you’re leaning too heavily on loans or external funding, which could signal cash flow issues beneath the surface. Interpreting these numbers in context allows you to forecast future cash requirements and respond to warning signs long before they impact your bottom line. An accurate flow analysis is a linchpin of effective cash flow management .

By making cash flow analysis a routine part of your operations, you gain control over managing cash and create the foundation for better business decisions, growth, and resilience—even during economic headwinds.

Essential Cash Flow Management Hacks for Small Businesses

- Forecasting free cash flow and setting financial goals

- Optimizing accounts receivable and accounts payable processes

- Leveraging automation for flow management

- Streamlining expenses to support healthy cash flow

Successful cash flow management for small businesses hinges on putting proven hacks into practice. Begin by forecasting free cash flow monthly; this helps you anticipate slow periods, ensure funding for payables, and make savvy investment decisions. Setting clear, achievable financial goals based on these forecasts transforms reactive cash management into a proactive process.

Optimizing your accounts receivable and accounts payable is another critical step. Send invoices promptly and develop policies that reward early payments to accelerate cash inflow . On the outflow side, negotiate better payment terms with suppliers whenever possible and monitor your accounts payable closely to avoid late fees that chip away at profits. The less cash tied up in obligations, the greater your free cash flow —fuel for growth and resilience.

Embracing technology amplifies these benefits. Modern cash flow management software automates tracking, generates real-time insights, and alerts you to potential issues before they become critical. Finally, regularly prune unnecessary expenses—from subscriptions to redundant processes—to protect your healthy cash flow and support continuous improvement.

Top 10 Strategies to Manage Cash Flow Like a Pro

- Create a rolling 12-month cash flow forecast

- Invoice promptly and clarify payment terms

- Regularly analyze cash flow statements and patterns

- Negotiate better terms with suppliers (accounts payable)

- Incentivize early payments in accounts receivable

- Limit unnecessary spending and control overhead

- Build an emergency cash reserve

- Monitor and address negative cash flow quickly

- Leverage financing tools during cash shortfalls

- Use cash flow management software for efficiency

By implementing these strategies, small businesses can build reliable reserves, react quickly to negative cash flow signals, and ensure sustainable progress—even in turbulent times.

Spotting and Preventing Negative Cash Flow

Even profitable businesses can struggle due to undiscovered negative cash flow . Proactive monitoring is crucial: regular reviews of cash flow statements reveal patterns that warrant attention. For instance, steadily increasing accounts receivable balances or habitual overdrafts indicate operational stress points. The most effective leaders address these issues promptly, minimizing disruption and safeguarding the company’s reputation.

By adopting best-in-class cash flow management tools and processes, you can spot warning signs early—giving your business a powerful edge. Investing time in reviewing aged payables and receivables, forecasting outflows, and refining your accounts payable management ensures you remain in control, rather than firefighting financial emergencies.

Warning Signs of Negative Cash Flow and How to Respond

- Consistent late supplier payments

- Rising accounts receivable delays

- Regular overdraft usage

- Declining free cash flow

If you experience any of these major alarms, take swift action: renegotiate payment terms, enhance your accounts receivable procedures, and consider short-term financing options to bridge temporary cash flow issues . Transparency and speed are key—waiting allows small problems to snowball into existential threats.

Effective Cash Flow Strategies: From Problems to Solutions

- Set measurable cash flow management KPIs

- Implement a daily, weekly, and monthly review process

Turn cash flow challenges into actionable solutions by defining specific KPIs such as average collection period or operating cash margin. Then, commit to a rigorously scheduled review: daily for operational cash, weekly for accounts trends, and monthly for big-picture analysis. This rhythm helps leaders identify issues before they impact overall financial health .

Unlocking Positive Cash Flow: Growth Hacks for Small Businesses

Building positive cash flow is the true inflection point where businesses move beyond mere survival to sustainable expansion. The goal is to convert cash from operations into new revenue streams, strategic hires, or capital improvements—fostering a resilient, opportunity-ready company.

Adopting practical growth hacks like reinvesting profits, enhancing your payment processing systems, and cultivating diverse income sources sets the stage for future-proof, scalable operations. True business triumph isn’t just avoiding negative cash flow —it’s designing a model where every dollar earned strengthens your foundation.

Building Cash Reserves and Planning for Expansion

Long-term stability depends upon disciplined cash reserve policies. By consistently allocating a portion of profits to an “emergency fund,” you create a safety net for unforeseen expenses, slow seasons, or investment opportunities. Planning for expansion means using free cash judiciously—evaluating when to upskill staff, purchase new assets, or enter fresh markets. Each step should be driven by robust flow analysis and clear ROI projections.

Avoid the temptation to deplete reserves for rapid growth. Instead, focus on balancing growth investments with liquidity—the more robust your reserves, the greater your ability to weather downturns without compromising opportunity.

Practical Steps for Sustainable and Healthy Cash Flow

- Allocate percentage of profits to reserve funds

- Upgrade payment processing solutions

- Diversify revenue streams

These practical actions help small businesses maintain healthy cash flow even as conditions fluctuate. By diversifying income, embracing better tech, and saving systematically, you put your company on a path to steady, positive cash cycles.

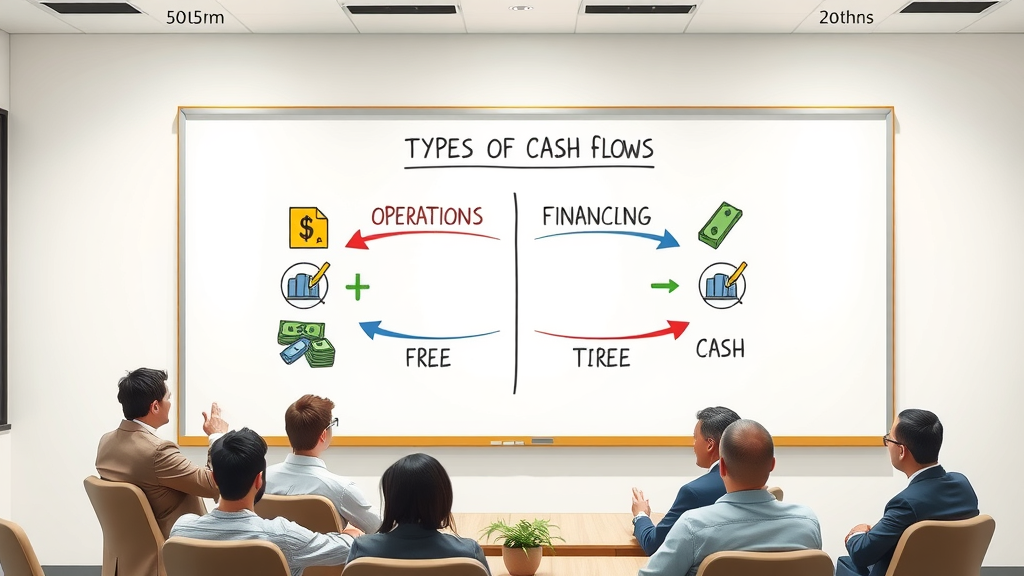

The Four Types of Cash Flows Explained

| Type of Cash Flow | Description | Example |

|---|---|---|

| Operating Cash Flow | Day-to-day business operations | Receipts from sales, payments to suppliers |

| Investing Cash Flow | Buy/sell investments & assets | Purchasing machinery, selling property |

| Financing Cash Flow | Raising funds or repaying capital | Bank loans, issuing stock |

| Free Cash Flow | Cash available after expenses & investments | Leftover funds after paying bills and reinvestments |

Each of these four types plays a vital role in cash flow management . Accurately tracking them lets you identify strengths and address gaps, laying the groundwork for strategic planning and confident decision-making.

People Also Ask: Demystifying Cash Flow Management

What do you mean by cash flow management?

Cash flow management is the practice of overseeing and optimizing the movement of money into and out of your business. It ensures that the cash inflows from sales or loans consistently exceed cash outflows for expenses, investments, and debt payments. This discipline helps businesses maintain sufficient funds to operate smoothly and support growth.

How do you manage cashflow?

To manage cash flow effectively, regularly monitor your cash flow statement , forecast future cash positions, expedite collections on accounts receivable , delay or negotiate more flexible accounts payable schedules, and limit unnecessary expenditure. Using flow management tools and following a structured review process are also essential for addressing potential cash flow issues before they escalate.

Is cash flow management a skill?

Absolutely. Cash flow management is a vital business skill that combines financial literacy with practical, real-world tactics. Developing this discipline involves continuous learning, regular review of financial statements, strategic decision-making, and adaptability to changing business conditions.

What are the four types of cash flows?

The four types of cash flows are Operating Cash Flow (from daily business activities), Investing Cash Flow (purchases/sales of assets), Financing Cash Flow (funding/repaying capital), and Free Cash Flow (liquid assets available after expenses). Mastery of each type allows for comprehensive cash flow analysis and resource optimization.

Best Practices in Cash Flow Management for Small Businesses

"Managing cash flow is about more than survival—it's enabling future growth and strategic evolution."

Industry leaders agree—the best-run small businesses treat cash flow management as an everyday, proactive discipline. This mindset ensures not just survival, but continuous improvement and valuable growth.

Adopt a structured approach: know your numbers, respond quickly to anomalies, and use evidence-based processes to guide decisions. Simple, repeatable routines set the stage for healthy cash flow and future scalability.

Simple Steps for an Effective Cash Flow Analysis

- Review regular flow statements

- Spot seasonal trends

- Identify inefficiencies or negative patterns

- Compare projections to reality

Each step contributes directly to stronger cash flow management . Analyze trends, compare targets to actual results, and adjust your strategy as needed—these small adjustments compound into big advantages over time.

Quick Recap: Key Takeaways for Healthy Cash Flow

- Always know your current cash position

- Build a 12-month rolling forecast

- Act quickly on negative cash flow indicators

- Standardize and automate your processes

- Set cash aside for future needs

Following these principles lays the foundation for enduring stability and resilient growth for your small business .

Frequently Asked Questions on Cash Flow Management

- How often should I update my cash flow analysis? It’s best practice to update your cash flow analysis at least monthly, though high-volume or rapidly changing businesses should consider weekly reviews. Ongoing updates help you spot cash flow issues early, adapt to trends, and maintain accurate forecasts for smarter decisions.

- What software is best for small business cash flow management? Several modern platforms—like QuickBooks, Xero, and FreshBooks—offer powerful cash flow management tools tailored to small businesses . Look for features such as real-time dashboards, automatic reminders for accounts receivable , and customizable financial reports.

- When should I seek professional cash flow advice? If you regularly experience negative cash flow , anticipate significant growth, or struggle to interpret financial statements, consult a professional. Financial advisors or accountants bring objective, expert insights and help you implement more effective cash flow management strategies.

Next Steps: Boost Your Cash Flow Management Today

Take control of your future—implement these cash flow management hacks now to protect, grow, and future-proof your business. Need help? Call Keith @ 1 833 229 5500 or send him an Email: connect@keithstoller.com

Effective cash flow management is crucial for the sustainability and growth of your business. To deepen your understanding and implement practical strategies, consider exploring the following resources:

-

Cash Flow Management Guide: Techniques and Strategies by Brex offers comprehensive insights into forecasting cash flows, conducting cash flow audits, and automating bill payments to enhance your financial stability.

-

Guide to Cash Flow Management by Sage Advice US provides practical tips on cash flow forecasting, monitoring, and optimizing accounts receivable and payable processes to maintain a healthy cash flow.

By leveraging these expert resources, you can implement proven techniques to manage your cash flow effectively, ensuring your business remains resilient and thrives in any economic climate.

Add Row

Add Row  Add

Add

Write A Comment